How to set the right price

Too high a price can scare customers away. Too low can hurt your bottom line. But there’s more to pricing than picking numbers. It’s about planning a pricing strategy that works for your business, your customers, and your suppliers and other partners.

Use pricing strategy to give everyone good value

A pricing strategy is a plan you use to set prices for your products or services so you, your customers, and your suppliers get the best value.

Pricing is easier to change than other parts of your approach to marketing. But it’s important to get it right. You’ll need to:

- research your customers and what they’re willing to pay

- research your competitors

- understand the value you offer to suppliers and customers.

Your pricing strategy needs to help you find the sweet spot that offers the most value for everyone involved. Look at whether:

- you make money from each sale after accounting for all your costs

- customers can afford your product or service and feel they get value from buying it

- suppliers and other collaborators get value from working with you.

How price-sensitive are your customers?

Customers typically buy less when prices go up, and more when prices go down. How much customers change their buying behaviour shows how price-sensitive they are.

If your customers are very price-sensitive, you lose sales if prices go up. Your revenue drops, because the extra income per item sold doesn’t make up for the reduction in sales. For example, a garage raising the price of wheel alignment checks from $49.99 to $55 might lose 40% of sales, even though the price rise was small.

If your customers are less price-sensitive, you only lose a few sales if prices go up. Revenue stays the same or even goes up. Using the same example, if the garage’s sales only drop 5%, they might end up better off because of more revenue, lower costs, or both.

Customers are often more price-sensitive for products with easy alternatives, or luxury goods they don’t really need. If either applies to your business, take extra care before increasing your prices. For example, an ice cream business raising prices might lose customers who:

- switch to a competing brand

- buy a different sweet treat

- buy a different type of treat, eg a magazine

- save their money and skip the treat.

Customers are often less price-sensitive if it’s something special or unique. So, a strong brand usually helps you set higher prices without putting people off. If you do plan to raise prices, it’s a good idea to strengthen your brand to prepare customers for the change. Explaining any price increases can also help keep loyal customers happy.

Whichever pricing strategy you choose, cover all your costs. Otherwise, you'll lose money on every sale.

Three types of pricing strategy

You can choose from several pricing strategies. Here are three popular types:

- cost-based pricing

- competitor-based pricing

- customer-based pricing.

Pick a strategy that suits your products or services, your situation, and your target customers.

Whichever you choose, it’s important to understand how your prices relate to your costs because it underpins your profitability. Look at things like:

- costs of everything you buy to make your product or service

- costs of employing the people who make your product or service

- other costs of keeping your business running.

One place to check costs is your profit and loss statement. P&L statements set out what you earn (revenue), what you spend (costs/expenses), and any profits made.

How to read profit and loss statements

Use numbers to analyse your business

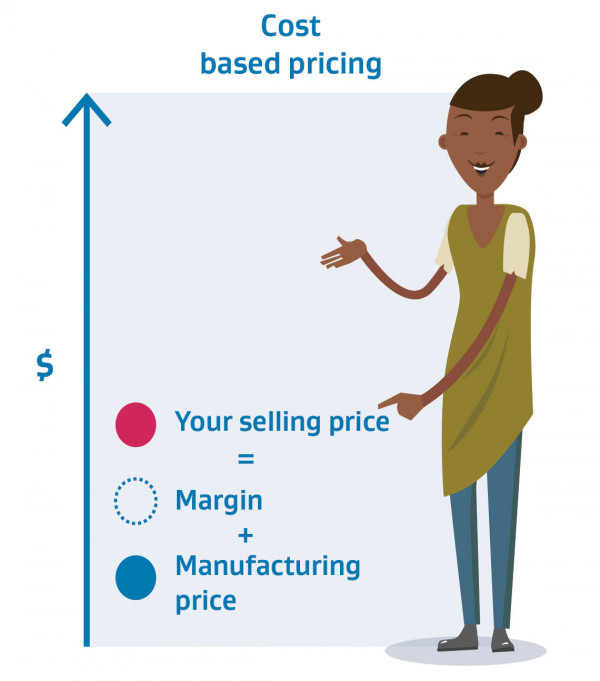

Pricing based on costs

Key factor: Covering costs and adding a margin.

Best for: Keeping prices down to attract customers motivated by low price tags.

Businesses often use cost pricing to set prices as low as they can. The price covers all costs involved in making a product or providing a service, plus extra to make a profit. The extra might be a percentage of costs, eg 25%.

Low prices can help you:

- squeeze the last bit of profit from an old product

- appeal to customers looking for cheaper options rather than top quality

- stand out in a competitive market.

Lower prices can also boost the appeal of products with fewer features or lower performance. If these products offer reasonable quality, customers get good value for money and you get a competitive advantage. But you’ll need low costs to make a profit. And customers are likely to move if a cheaper alternative arrives.

What is quality, and why is it so important?

Pricing based on competitors

Key factor: Understanding your market position and what competitors charge.

Best for: Businesses with a strong brand and a good understanding of their competitors and their industry.

You might match a competitor’s prices and use something else to win customers, eg advertising, customer service, or your brand. Or, you might opt for higher or lower prices depending on how you compare for:

- value you offer

- how well-known your brand is

- how much and how well you advertise.

It’s also important to think about whether your competitors set logical prices, and how their costs compare to yours. Your price needs to be profitable. For example, a café committing to always sell takeaway coffee cheaper than its competitors needs lower costs.

Another option is to sell a quality product or service at a lower price, eg to win customers when launching a new product or entering a new market. This is called penetration pricing. For example, a new winemaker might offer a discount to attract customers away from competing brands. If customers like the wine, they may continue to buy it at full price.

There are downsides. You may lose customers when the special offer ends. Some may think your product is only worth the discount price. Check your business can survive the special offer, even if you lose money on it. You need to be confident the special offer makes sense in the long run.

Market research can show you if enough customers are interested in your product or service for a discount offer to make sense.

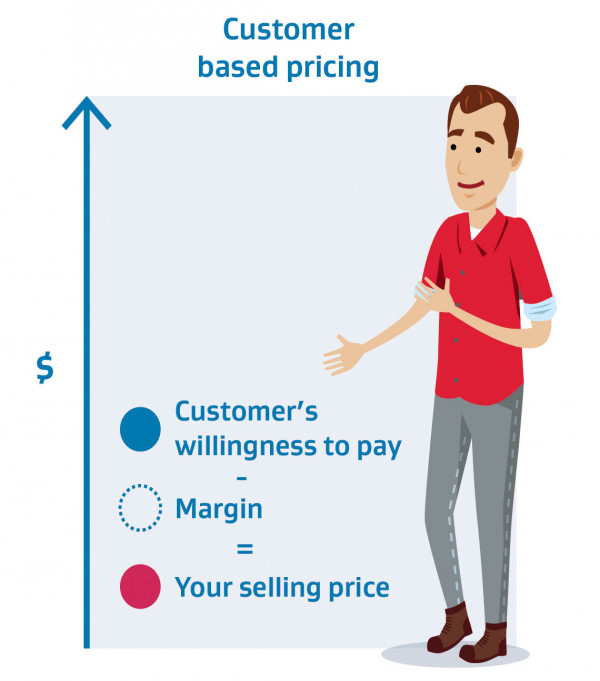

Pricing based on customer insights

Key factor: Using customer research to figure out the highest price people are willing to pay.

Best for: Products or services likely to appeal to customers who value quality.

This strategy could include interviewing or surveying customers about their willingness to pay for a product or a service.

If you have a great product and a strong brand, customers may be willing to pay top dollar. A high price may even support your brand’s premium image, although rivals with lower prices may take some sales from you. Forecast sales carefully to make the most of demand without producing too much.

Overall, customer pricing could be right for you if all these are true:

- you know what customers are willing to pay

- you are confident your product or service appeals to customers

- you create extra value, eg expert help or a great sales experience.

It helps to work out customer lifetime value, the profit you make throughout the time someone remains a customer.

Case study

Sarah explores pricing pros and cons

After 10 years working for a graphic design agency, Sarah feels it’s the right time to launch her own business. She’s not too sure how to price her services, so she explores the different pricing strategies.

First she considers a pricing strategy based on costs. This best suits customers with lower budgets and businesses able to keep costs low. If Sarah’s costs rise and she has to charge more, she risks losing her price-sensitive customers. Sarah decides pricing based on costs is not the right fit. She wants to create lasting customer relationships.

Next Sarah looks at pricing based on her competitors. She knows what her old agency used to charge. She researches how other graphic designers price their work. She reflects on their level of experience and business expenses, eg home office vs central city studio.

Sarah decides to set her prices in the mid-range. She’s more experienced than her low-price competitors. As she works from home, her costs are lower than competitors at the top end of the price range. To attract customers to her new business, she decides to offer an introductory discount.

Other marketing strategy resources

Content to help you create your marketing strategy

Build a brand your customers will love

Every business has a brand. Discover how to build yours and use it to attract customers and forge connections.

Use insights to sell the right thing in the best place

When you deeply know your target customers, use these insights to identify what to sell and where best to sell it.

Find the best way to promote your business

Online or face to face, there are many ways to communicate with customers. Here’s how to choose and plan.